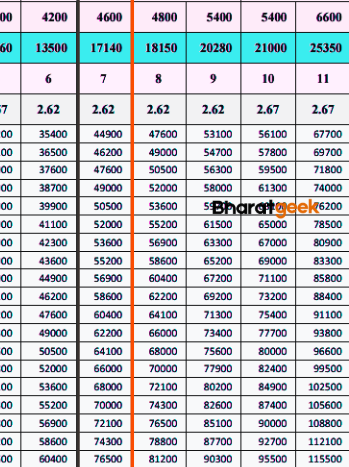

| Event | Details |

|---|---|

| Pay Level | 7 |

| Pay Band | 9300 - 34800 |

| Grade Pay | 4600 |

| Pay Scale | 44900 - 142400 |

| Basic Salary | 44900 |

| Maximum Salary | 1,42,400 |

| DA Allowance | 23797 (53% of Basic Salary) |

| HRA Allowance | 8980 |

| TA Allowance | 4000 |

| Other Allowance | 5000 |

| NPS Deduction | 6870 (10% of Basic Salary + DA) |

| PF Deduction | 8244 (12% of Basic Salary + DA) |

| Income Tax Deduction | 4000 |

| Monthly Gross | 86677 |

| Yearly Gross | 1040124 |

| Monthly In Hand | 67563 |

| YearlyIn Hand | 810756 |

SSC CGL IT Salary State Wise

| State | Pay Scale |

|---|---|

| Uttar Pradesh | 44900 - 1,42,400 |

| Maharashtra | 44900 - 1,42,400 |

| Bihar | 44900 - 1,42,400 |

| West Bengal | 44900 - 1,42,400 |

| Madhya Pradesh | 44900 - 1,42,400 |

| Odisha | 44900 - 1,42,400 |

| Jharkhand | 44900 - 1,42,400 |

| Haryana | 44900 - 1,42,400 |

| Uttarakhand | 44900 - 1,42,400 |

Note: Pay Scale for an Income Tax Inspector in India is standardized across all state

Benifits and Perks

| Benefit | Status |

|---|---|

| Housing and Accommodation | |

| Family Medical | |

| Travel | |

| Dearness and Special Allowance | |

| Festival Bonus | |

| Pension and Retirement |

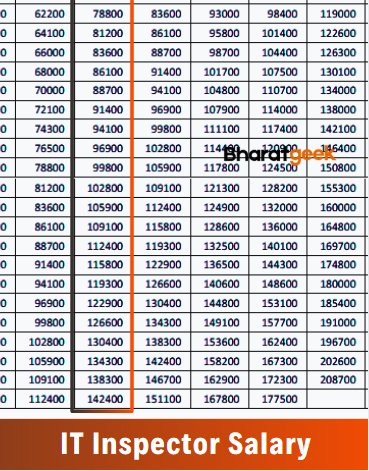

Promotions

| Rank | Pay Scale |

|---|---|

| Income Tax Inspector Joining yr | Rs 44,900 - 1,42,400 |

| Income Tax Officer After 5–7 yr | Rs 53,100 - 1,67,800 |

| Assistant Commissioner of IT After 10–12 yr | Rs 56,100 - 1,77,500 |

| Deputy Commissioner of IT After 14–16 yr | Rs. 67,700 - 2,08,700 |

| Joint Commissioner of IT After 18–20 yr | Rs 78,800 - 2,09,200 |

| Additional Commissioner of IT After 22–24 yr | Rs 1,23,100 - 2,15,900 |

| Commissioner of IT After 26–28 yr | Rs 1,44,200 - 2,18,200 |

| Principal Commissioner of IT After 30–32 yr | Rs 1,82,200 - 2,24,100 |

| Chief Commissioner of IT After 34–36 yr | Rs 2,05,400 - 2,24,400 |

| Principal Chief Commissioner of IT After 37–40+ yr | Rs. 2,25,000 (Fixed) |