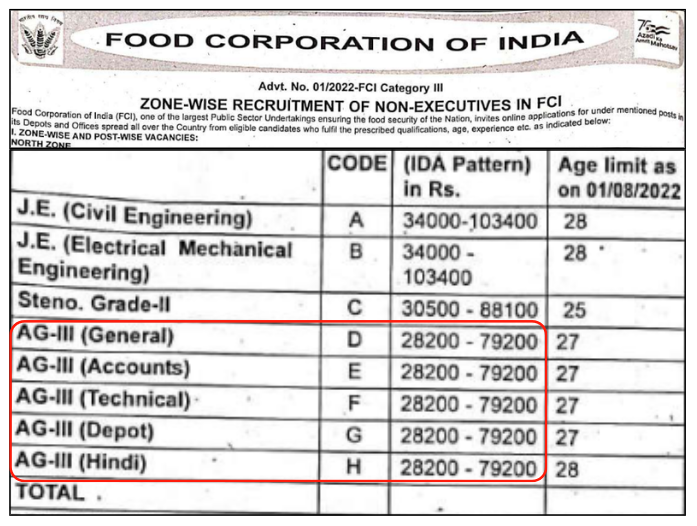

| Event | Details |

|---|---|

| Pay Scale | 28200 - 79200 |

| Basic Salary | 28200 |

| Maximum Salary | 79,200 |

| DA Allowance | 14100 (50% of Basic Salary) |

| HRA Allowance | 7614 |

| Lunch Allowance | 1410 |

| Housekeeping Allowance | 4000 |

| Domestic Support Allowance | 1400 |

| Recreation Allowance | 1700 |

| Entertainment Allowance | 1692 |

| Washing/Elec. Allowance | 1200 |

| NPS Deduction | 5076 (10% of Basic Salary + DA) |

| Benevolent Fund Deduction | 150 |

| Medical Health Sch. Deduction | 60 |

| Emp. Soc. Security Deduction | 70 |

| Union Subscription Deduction | 100 |

| Monthly Gross | 61316 |

| Yearly Gross | 735792 |

| Monthly In Hand | 53660 |

| YearlyIn Hand | 643920 |

FCI AG-3 Salary After 8th Pay Commission: basic salary is expected to range from ₹54,144 to ₹64,296. Including allowances, the total gross monthly salary may be around ₹75,000 to ₹88,000.

FCI AG-3 State-Wise Salary 2026 (India)

| State | Pay Scale |

|---|---|

| Uttar Pradesh (UP) | ₹28200 - 79,200 |

| Bihar | ₹28200 - 79,200 |

| Madhya Pradesh (MP) | ₹28200 - 79,200 |

| Jharkhand | ₹28200 - 79,200 |

| Uttarakhand | ₹28200 - 79,200 |

| Delhi | ₹28200 - 79,200 |

Note: FCI employees in UP, Bihar, MP Jharkhand, and other Indian states receive the same salary level.

FCI AG-3 Perks & Allowances

| Benefit | Status |

|---|---|

| HRA | |

| Electricity and Water Bill | |

| Medical & Food Expenses | |

| Transport Allowances | |

| Dearness Allowance | |

| Festival Bonus | |

| Periodic Promotion | |

| Entertainment Allowance | |

| Domestic Assistance | |

| Mobile Telephone Reimbursement | |

| Dress Allowance | |

| Night Allowance |

Check Similar Salary:

➤ FCI AGM Salary 2026

➤ Bharatgeek Home Page

FCI AG-3 Promotion Structure & Salary

| Rank | Pay Scale |

|---|---|

| FCI AG 3 (Grade 3) Joining yr | ₹28200 – 79200 |

| FCI AG 2 (Grade 2 / Manager) 12 - 15 yr | ₹30500 – 88100 |

| FCI AG1 (Grade 1 /Sr Manager) Seniority yr | ₹34000 – 103400 |

➤ FCI AG-III Training Period Salary: FCI Assistant Grade 3 (AG-III) training usually lasts 1-year. During this period, under the 7th Pay Commission, the monthly gross salary is around ₹42,000–₹47,000, which includes a basic pay of ₹28,200 and other allowances.