| Event | Details |

|---|---|

| Pay Scale | 25220 - 80910 |

| Basic Salary | 25220 |

| Maximum Salary | 80,910 |

| DA Allowance | 8491 (33.67% of Basic Salary) |

| HRA Allowance | 7566 |

| City Compensatory Allowance | 500 |

| Key Allowance | 90 |

| APGLI Subscription Deduction | 800 |

| GIS Ins Fund Deduction | 15 |

| CPS Deduction | 2500 |

| Professional tax Deduction | 200 |

| Non GovtDedn Deduction | 50 |

| EHF SUBSCRIPTION Deduction | 300 |

| Monthly Gross | 41867 |

| Yearly Gross | 502404 |

| Monthly In Hand | 38002 |

| YearlyIn Hand | 456024 |

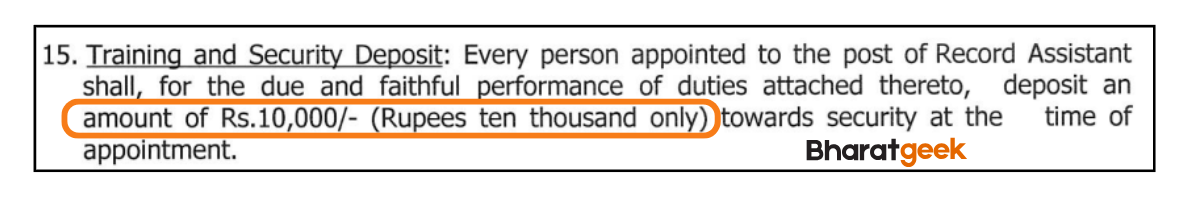

Note: Selected candidates must deposit ₹10,000 as security at the time of appointment to ensure responsible job conduct.

Benifits and Perks

| Benefit | Status |

|---|---|

| Dearness Allowance | |

| HRA | |

| City Compensatory Allowance | |

| Government Home & Car | |

| Key Allowance | |

| Medical Allowance | |

| Provident Fund (PF) | |

| Government Home & Car | |

| Pension and Gratuity | |

| Periodic Promotion |

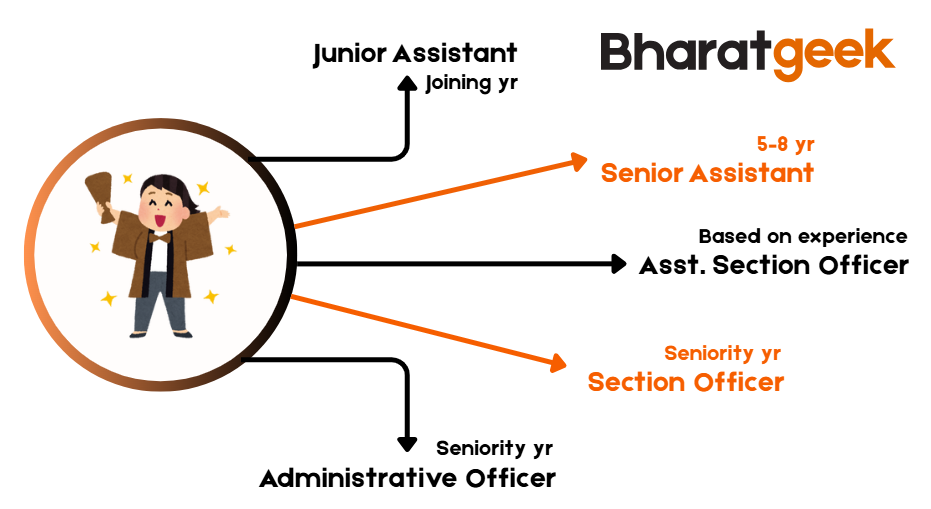

Promotions

| Rank | Pay Scale |

|---|---|

| Junior Assistant Joining yr | ₹25220 – 80910 |

| Senior Assistant 5–8 yr | ₹28280 – 89720 |

| Assistant Section Officer Based on experience yr | ₹32670 – 101970 |

| Section Officer Seniority yr | ₹35570 – 109910 |

| Administrative Officer Seniority yr | ₹38720 – 118390 |