Advertisement

| Event | Details |

|---|---|

| Pay Level | 5 |

| Pay Band | 5200 - 20200 |

| Grade Pay | 2800 |

| Pay Scale | 29200 - 92300 |

| Basic Salary | 29200 |

| Maximum Salary | 92,300 |

| DA Allowance | 16060 (55% of Basic Salary) |

| HRA Allowance | 2920 |

| TA Allowance | 4000 |

| NPS Deduction | 4526 (10% of Basic Salary + DA) |

| PF Deduction | 5431 (12% of Basic Salary + DA) |

| CGEGIS Deduction | 20 |

| CGHS Deduction | 350 |

| Monthly Gross | 52180 |

| Yearly Gross | 626160 |

| Monthly In Hand | 41853 |

| YearlyIn Hand | 502236 |

Advertisement

Benifits and Perks

| Benefit | Status |

|---|---|

| Basic Pay | |

| Dearness Allowance (DA) | |

| House Rent Allowance (HRA) | |

| Transport Allowance (TA) | |

| Fixed Working Hours | |

| Posting Location | |

| Work-Life Balance | |

| Medical Facilities | |

| Festival Bonus | |

| Leave Benefits | |

| Periodic Promotion |

Advertisement

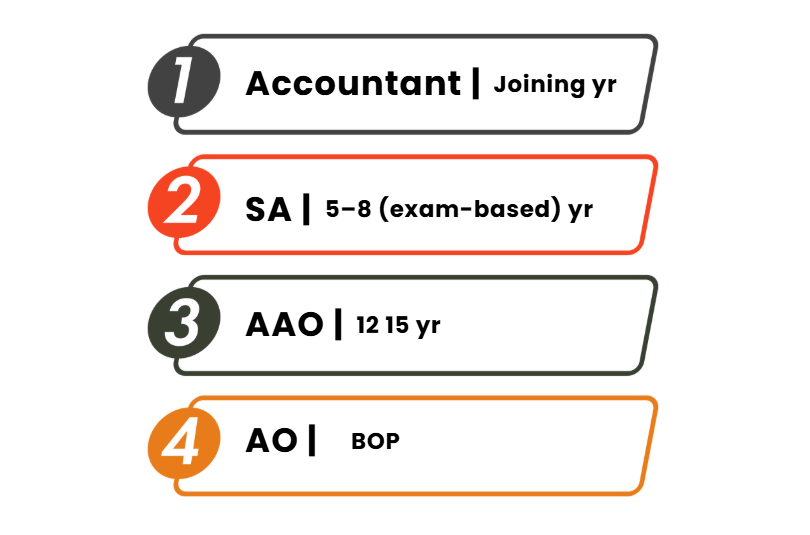

Promotions

| Rank | Pay Scale |

|---|---|

| Accountant Joining yr | ₹29,200 – 92,300 |

| Senior Accountant 5–8 (exam-based) yr | ₹35,400 – 1,12,400 |

| Assistant Accounts Officer 12–15 yr | ₹44,900 – 1,42,400 |

| Accounts Officer Based on performance yr | ₹47,600 – 1,51,100 |

Advertisement